Sbi PPF Calculator

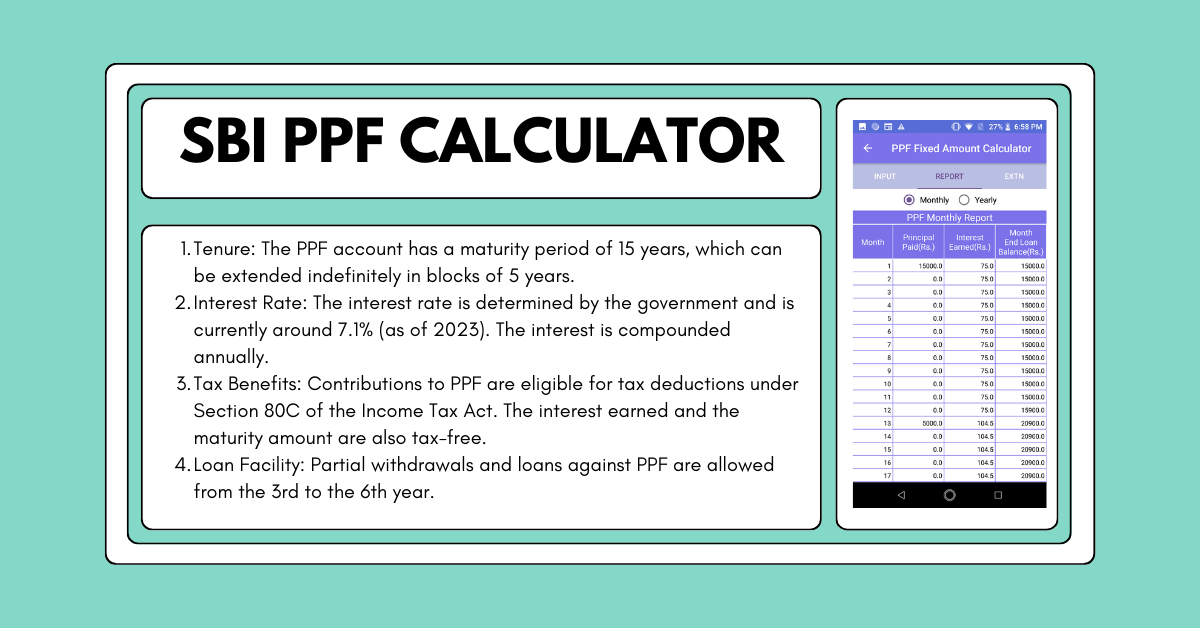

The SBI PPF Calculator is an essential tool for individuals who wish to invest in the Public Provident Fund (PPF) offered by the State Bank of India (SBI). The PPF scheme is a long-term savings instrument that provides tax benefits and attractive interest rates. SBI’s PPF calculator helps investors estimate their maturity amount based on their annual contributions and the prevailing interest rates.

In this guide, we will explore the SBI PPF Calculator, its features, how to use it, and the benefits of investing in an SBI PPF account.

What is the SBI PPF Calculator?

The SBI PPF Calculator is an online tool that helps users calculate their potential returns from a PPF investment. It takes into account the annual deposit, the applicable interest rate, and the investment tenure to provide an estimated maturity amount.

Features of SBI PPF Calculator:

- User-Friendly Interface – Simple and easy to use.

- Accurate Calculations – Provides precise maturity amount based on inputs.

- Time-Saving – Eliminates the need for manual calculations.

- Tax-Free Growth Estimation – Helps understand tax benefits.

- Flexible Deposits – Users can check returns for different deposit amounts.

How to Use the SBI PPF Calculator?

Using the SBI PPF Calculator is straightforward. Follow these steps:

Step 1: Enter the Investment Amount

- Enter the amount you plan to deposit in your PPF account annually.

- The minimum deposit is ₹500, and the maximum is ₹1.5 lakh per financial year.

Step 2: Select the Investment Duration

- The minimum tenure for a PPF account is 15 years.

- You can extend the tenure in blocks of 5 years after maturity.

Step 3: Enter the Interest Rate

- SBI updates the PPF interest rate every quarter.

- As of recent data, the interest rate is around 7.1% per annum (subject to change).

Step 4: Calculate and View Results

- Click on the ‘Calculate’ button.

- The tool will display the maturity amount, total interest earned, and final balance.

Formula Used in SBI PPF Calculator

The SBI PPF calculator follows a compounded annual formula:

Where:

- A = Maturity amount

- P = Annual investment amount

- r = Interest rate per annum

- n = Number of years

For example, if you invest ₹1,50,000 per year at an interest rate of 7.1%, your estimated maturity amount after 15 years would be around ₹40 lakh.

Benefits of Using SBI PPF Calculator

1. Accurate Financial Planning

The calculator helps users plan their savings and investments efficiently.

2. Tax Exemption Under Section 80C

Investments up to ₹1.5 lakh per year in a PPF account qualify for a tax deduction under Section 80C of the Income Tax Act.

3. Risk-Free Investment

PPF is backed by the Government of India, making it a secure and risk-free investment.

4. Flexibility in Deposits

Investors can deposit a lump sum or in monthly installments (maximum 12 installments per year).

5. Loan Facility

Investors can avail loans against their PPF balance from the 3rd to the 6th year of investment.

6. Partial Withdrawals

After 7 years, partial withdrawals are permitted, making it a flexible long-term savings scheme.

SBI PPF Account: Key Details

| Feature | Details |

|---|---|

| Minimum Deposit | ₹500 per year |

| Maximum Deposit | ₹1.5 lakh per year |

| Lock-in Period | 15 years |

| Interest Rate | Around 7.1% (subject to change) |

| Loan Facility | Available from 3rd to 6th year |

| Partial Withdrawals | Allowed after 7 years |

| Tax Benefits | EEE (Exempt-Exempt-Exempt) tax status |

SBI PPF Interest Rate Trends

The PPF interest rate is revised every quarter by the Government of India. Here is a look at the recent trends:

| Financial Year | Interest Rate |

| 2021-22 | 7.1% |

| 2022-23 | 7.1% |

| 2023-24 | 7.1% |

The rate remains competitive compared to other fixed-income investment options.

Frequently Asked Questions (FAQs)

1. Can I withdraw my SBI PPF balance before 15 years?

- No, full withdrawal is not allowed before 15 years. However, partial withdrawals can be made after 7 years.

2. Is the maturity amount taxable?

- No, the maturity amount and interest earned are completely tax-free under Section 10(11) of the Income Tax Act.

3. Can I extend my SBI PPF account beyond 15 years?

- Yes, after maturity, you can extend your PPF account in blocks of 5 years with or without contributions.

4. What happens if I fail to deposit the minimum amount?

- Your account will become inactive, but you can reactivate it by paying a ₹50 penalty along with the minimum deposit of ₹500.

5. Can I open multiple PPF accounts?

- No, one person can have only one PPF account. However, parents can open PPF accounts for their minor children.

The SBI PPF Calculator is a highly effective tool for investors looking to maximize their returns while enjoying tax benefits. By understanding how it works and utilizing it for financial planning, individuals can make informed decisions regarding their long-term savings.

With its secure investment structure, flexibility, and compounding benefits, SBI PPF remains one of the best investment options for those seeking wealth accumulation and tax savings.

If you are planning to invest in SBI PPF, use the SBI PPF Calculator to estimate your returns and make a well-informed investment strategy!